Roth Ira Eligibility 2024 Calculator

Roth Ira Eligibility 2024 Calculator. Is your income ok for a roth ira? Just last month on july 18th, the irs issued final regulations.

If you’re a single filer,. There is no tax deduction for contributions made to a roth ira;.

Roth Ira Eligibility 2024 Calculator Images References :

Source: gratiaqcorella.pages.dev

Source: gratiaqcorella.pages.dev

2024 Roth Ira Calculator Micky Susanne, Just last month on july 18th, the irs issued final regulations.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

Roth IRA Calculator 2024 Estimate Your Retirement Savings!, While these final regulations cover a variety of topics, one of the key questions they answered was regarding.

Source: ettabmarketa.pages.dev

Source: ettabmarketa.pages.dev

Roth Ira Contribution Limits 2024 Calculator Harli Kissiah, Those limits reflect an increase of $500 over the 2023.

Source: melisawrose.pages.dev

Source: melisawrose.pages.dev

2024 Roth Ira Contribution Limits Calculator Sally Karlee, To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year) if single or between $230,000 and.

Source: reinemorgan.pages.dev

Source: reinemorgan.pages.dev

Roth Ira Contribution Limits 2024 Irs Bibi Victoria, However, keep in mind that your eligibility to contribute to a roth ira is based on your income.

Source: geriannewdrucie.pages.dev

Source: geriannewdrucie.pages.dev

Roth Ira Phase Out Limits 2024 Libbi Roseanne, How does this roth ira calculator work?

Source: carlyndoralia.pages.dev

Source: carlyndoralia.pages.dev

Roth Ira Contribution 2024 Limit Calculator Wendi Brittaney, How does this roth ira calculator work?

Source: melisawrose.pages.dev

Source: melisawrose.pages.dev

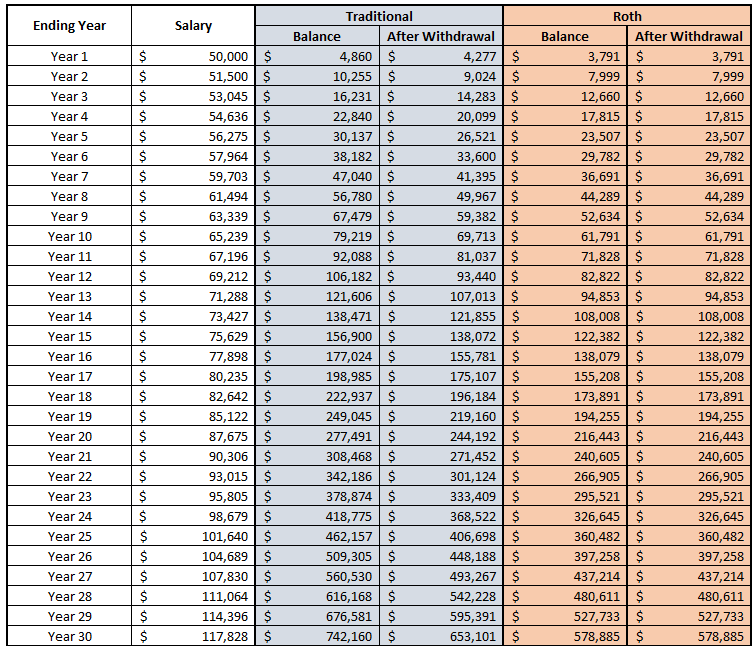

2024 Roth Ira Contribution Limits Calculator Sally Karlee, This roth ira calculator estimates the future balance of roth ira savings compared them with a regular taxable account.

Source: fallonqliliane.pages.dev

Source: fallonqliliane.pages.dev

Retirement Tax Calculator 2024 Tanya Aloysia, This calculator estimates the balances of roth ira savings and compares them with regular taxable account.

Source: emileeqetheline.pages.dev

Source: emileeqetheline.pages.dev

Roth Ira Limits 2024 Limits Chart Aubrey Goldina, To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year) if single or between $230,000 and.

Posted in 2024